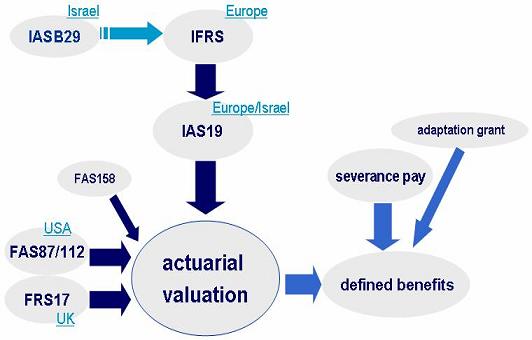

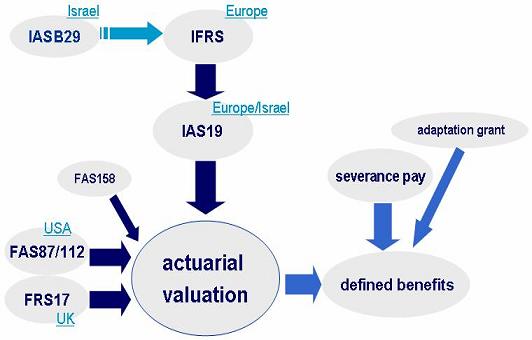

Israel Accounting Standard No. 29

With the implementation of Standard No. 29 of the Israel Accounting Standards Board (adoption of International Financial Reporting Standards - IFRS), an actuarial valuation of employers' defined benefit employee liabilities is required for all public companies. These valuations must be reported from year 2008, and comparative reporting is required during the transition year 2007. The rights that will be calculated: retirement rights, post-retirement rights and short-term rights (except for capital compensation program rights). Effectively an initial valuation is required from the beginning of year 2007.

IAS19 – International Accounting Standard No. 19

The basic principle of IAS19 is recognition of employee benefit costs during the period in which the benefit accrues rather than the date of payment. Liability classifications include: statutory regulation and constructive liabilities.

Included liabilities:

-- Short-term (within 12 months) – salary, social benefit costs, vacation,

illness, bonus, vehicle etc.

-- Post-employment rights – pension, insurance, medical etc.

-- Long-term (over 12 months) – deferred bonus, profit sharing etc.

-- Severance pay

IAS19 recommends valuation of liabilities by a qualified actuary.

Financial reporting

Actuarial methodology

The actuarial valuation is based on calculations of the type:

[Expected future sum of payment] x [payment execution probability] x [current value coefficient]

The value related to each employee will be calculated for each year until retirement. The actuarial valuation will sum up all calculated values for all years for all employees.

Projected Unit Credit Method

IAS19 prescribes the Project Unit Credit Method. The purpose of this actuarial method is to maintain accumulating assets, so that including investment profits but excluding future deposits, they will suffice to finance all liabilities attributed to the employment period up to the last payment for the last employee. This method accounts for all the assets and rights accumulated until the time of valuation, and includes adjustment for future salary changes. It also includes an assessment of future liabilities generated by the first year. |